Nev Virk Notary Corp.

Virk Notaries: Complete Documentation & Notary Services in the Lower Mainland

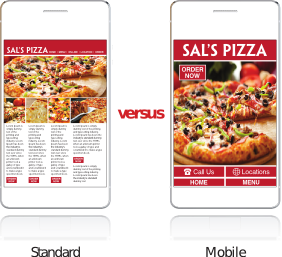

Google has made a major update to its mobile search algorithm, the move is causing ripples across the web. Websites not deemed mobile-friendly will be dropped down the search rankings, dramatically reducing the number of visitors to a site. Search engine ranking experts have called the potential fallout from the changes "mobilegeddon". Businesses at risk are those who don’t know about it.

After 21 April 2015, a lot of small businesses are going to be really surprised that the number of visitors to their websites has dropped significantly. This is will affect millions of sites on the web.” Companies spend significant amounts of money and effort to appear high up in Google rankings, with places on the first page of results highly prized. Text that is too small to read on a mobile device, plus links that are too close together, will fall down the mobile ranking list. Most businesses are now getting 50% to 60% of search results from mobile devices. If you’re not ready your search results are going to halved!

With Homemove.biz your mobile site is FREE. Easily changeable and exportable to work with your other websites.

For more info CLICK HERE or call Clements Clements at 1-877-613-2232