Fairway Mortgage

National Strength, Hometown Service

At Fairway, customer service is a way of life. It’s our job to take care of you better than anyone else.

You can rely on me for smart home financing options and exceptional service. After all, Fairway believes we are only as good as our last loan. You remain a highly valued client of mine and, of course, I look forward to continuing to take care of your mortgage needs.

Purchasing a new home?

Purchasing a new home? Congratulations on your decision to buy a new home! There are many important things to consider throughout the process, especially if you're a first-time homebuyer.

Applying for a loan?

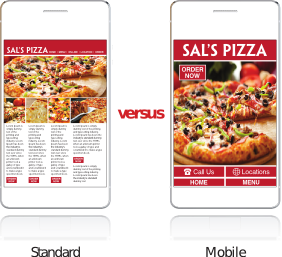

Applying for a loan? Our online application process is conveniently designed to allow you to stop any time and pick up where you left off. After you submit an appli